Tax

RECENT ARTICLES

Airbnb Tax Loophole: Short-Term Rental Hack

December 25, 2023 11:12 am by LawInc Staff

Generating rental income often requires navigating tricky tax obligations around property assets and profits declared. However, many investors remain unaware of a handy tax loophole letting short-term rental hosts like...

Spouse on Payroll: Genius Tax Hack or S Corp Pitfall? Unlocking the Secrets

December 20, 2023 12:12 pm by LawInc Staff

Having your spouse on the S corporation payroll can be advantageous for tax purposes if done correctly and strategically. Tax benefits include paying less overall, qualifying for deductions, and optimizing...

Cybertruck and S Corporations: An Electric Combo for Business Taxes

December 08, 2023 02:12 pm by Zach Javdan

When it comes to electric pickups, Tesla’s long-teased Cybertruck has revved up a lot of chatter. Its recent customer deliveries and angular styling definitely turn heads. But beyond the hype...

How LLC Owners Get Paid: Salaries, Distributions and Combinations

November 24, 2023 01:11 pm by LawInc Staff

As a limited liability company (LLC) owner, determining how to pay yourself appropriately involves key considerations around taxes, liability protection, and financial planning. With multiple options available, what is the...

Home Office Deduction Breakdown

November 21, 2023 01:11 pm by LawInc Staff

The home office deduction lets you deduct expenses when using your home for business. With over 4 million Americans claiming this deduction, it remains a popular option for small business...

California S Corporation: Dangerous Formation Mistakes

January 10, 2023 07:01 pm by LawInc Staff

California S corporations offer great benefits like limited liability protection and tax savings. Unfortunately, many S corporation owners often miss critical steps during the incorporation process which can lead to...

How to Save Thousands in Taxes With an S Corporation

January 06, 2022 11:01 am by Bryan Kesler, CPA

It’s a well-documented fact that over 70% of businesses in the USA comprise sole proprietorships. This means that they are a single-owner enterprise, with the owner functioning independently. Sole proprietorships...

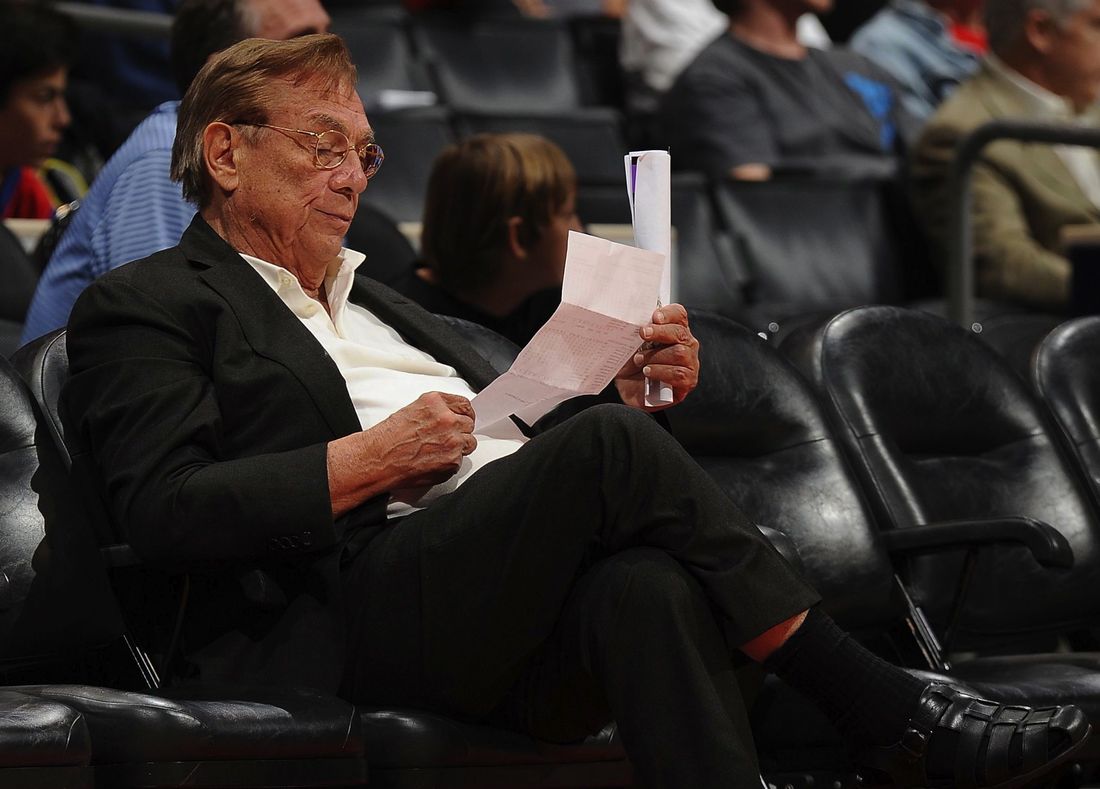

Donald Sterling May Actually Save Money on His Taxes

May 05, 2014 03:05 pm by Sheren Javdan

Los Angeles Clippers owner Donald Sterling, who was banned by the NBA for life last week for his racist remarks, might actually not have to pay as much in taxes...

Small Business Owners Struggle Most With Tax Prep: Not Taxes

April 16, 2014 02:04 pm by Sheren Javdan

Two things in life are certain: death and taxes. But for small business owners, the large amount of money due at the end of the tax season is not the...

Bitcoin Deemed A Property, Not Currency, By I.R.S.

April 09, 2014 11:04 am by Sheren Javdan

The Internal Revenue Service (IRS) announced today that it would tax Bitcoin as property rather than currency. This announcement comes just before the April 15 tax deadline looming around the...