Consider forming your California corporation or LLC during the last 15 days of the year to get a head start and avoid tax filing requirements for this year.

by LawInc Staff

November 7, 2022

Looking to get a head start with your California corporation or LLC and avoid potential filing backlogs right after the New Year?

Consider incorporating or forming an LLC between December 17 and December 31.

California’s 15-day rule allows you to incorporate or form an LLC during the last 15 days of the year and avoid filing tax returns for 2022.

California Corporations

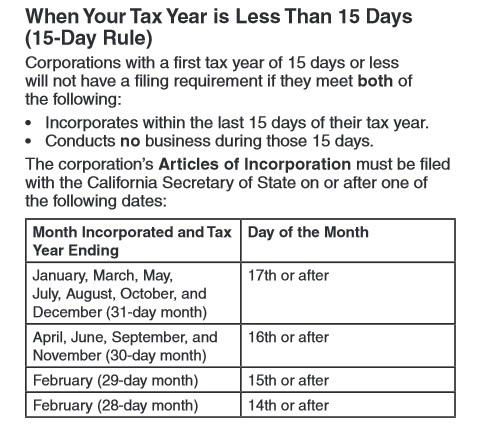

Pursuant to California Franchise Tax Board Publication 1060, corporations with a tax year of 15 days or less will not need file a tax return as long they do not conduct any business during those days:

Via California Franchise Tax Board

California Corporation $800 Minimum Tax

California corporations are required to pay an $800 minimum tax starting the second year of existence. This means that a corporation filed with the California Secretary of State on December 1 would be required to pay the $800 minimum tax by April 15 of the following tax year.

However, a corporation that files within the last 15 days of the year, and does not engage in any business during those 15 days, would not need to pay the $800 minimum tax the following year.

For example, Acme, Inc. files its Articles of Incorporation with the California Secretary of State on December 18, 2021. The corporation does not engage in any business activity between December 17 and December 31, 2022.

Acme, Inc. meets the requirements of California’s 15-day rule and will not need to file a California tax return for 2022. January 1, 2023 is the first day of its first tax year.

The $800 minimum tax would not be due until 2024.

California LLCs

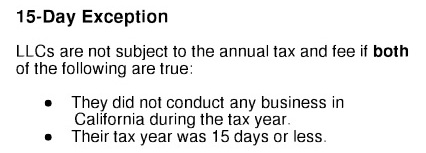

LLCs are basically subject to the same California 15-day rule. According to FTB 3556, the $800 tax is waived if no business is conducted during the 15 days and the LLC is filed between December 17 and 31:

via California Franchise Tax Board

Annual California LLC $800 Minimum Tax

As of 2021, California LLC’s are not required to pay the $800 minimum tax until the second year of existence.

In the past, the California Franchise Tax Board required newly formed California LLCs to pay an $800 minimum tax within approximately three and a half months of formation.

So if you form your California LLC on December 17, and do not conduct any business between December 17 and December 31, you would not need to make the $800 payment to the Franchise Tax Board until 2024.

ALSO SEE: Is Your Corporation Protecting You? Take This Corporate Maintenance Vulnerability Test