Want to incorporate your business in Nevada? Be sure to consider the consequences. Unless you and your business are based out of Nevada, you will likely not save any money and may not be protected in case of a lawsuit.

by LawInc Staff

May 31, 2017

Nevada incorporation can sound appealing with all the hype out there. Business owners and entrepreneurs, based outside of Nevada, often ask if a Nevada corporation is right for them.

Often lured by infomercials and illusions of running a business without paying income taxes, many small business owners set themselves up for inevitable business disaster by failing to account for the consequences of essentially engaging in tax evasion.

Business owners also fail to realize that if their business is not actually based out of Nevada, a Nevada corporation will not protect them in case of a lawsuit.

Ultimately, if not done for the right reasons, the decision to form a corporation in Nevada could result in disastrous consequences for you and your business.

Should I Incorporate in Nevada to Save on Taxes?

Incorporating in Nevada can actually increase your tax bill if you and your business are not based out of Nevada.

Do you live in Nevada? Is your business headquartered in Nevada? Do you or your employees work in Nevada? Does your business own real estate in Nevada? If you answered “no” to any of these questions then you are not part of the Nevada tax system and you should not incorporate in Nevada.

For example, if you live in California, your business is based out of California and your employees are in California, then you are part of the California tax system and you should most likely incorporate in California.

This means that you must pay taxes in California, even if you incorporate in Nevada.

Forming a corporation in another state, like Nevada, with apparent lower corporate income tax is not likely to save you much money. If your business is making money from business conducted in California, even if incorporated in another state, you must still pay California taxes on the income. That is, you would be paying taxes in two states, potentially doubling your tax bill.

Business owners are misled to believe that incorporating in a state that has no income tax, their business will not have to pay income tax. That is simply not the case.

You are usually responsible for paying taxes in the state where the income is earned. So if your business is making money in California, you are going to have to pay income tax in California. This is the case whether or not you have a corporation or LLC in Nevada or any other state that doesn’t have a state income tax.

Being naive about this can have dire consequences. Many business owners have lost everything after being audited by their state tax boards.

According to the California Franchise Tax Board, meeting any of the following criteria will result in a determination that a business entity is doing business in California: (1) Engaging in “any transaction in California” for the purpose of making money. (2) Organizing or managing a business in California. (3) The business sales in California exceed $500,000 or 25 percent of the total business sales. (4) The business property in California exceeds $50,000 or 25 percent of the total business property. (5) Compensation paid by the company in California exceeds $50,000 or 25 percent of the total compensation.

The California Franchise Tax Board further mentions how “it does not take much” for a company to be considered to be doing business in California and that a company found to be “doing business” in California will be required to file California tax returns and pay the minimum $800 annual tax.

ALSO SEE: Where Should I Incorporate My Business?

The California Franchise Tax Board is notorious for going after business owners that are incorporated in Nevada, but have some present or past connection to California. The Franchise Tax Board will take extreme measures to get what they feel they are owed.

In Gilbert Hyatt v. California Franchise Tax Board (FTB), Gilbert Hyatt, an extremely successful inventor, relocated to Nevada in 1991. After moving to Nevada, he received a $40 million licensing payment in connection with a patent he developed while still living in California.

The California FTB wanted its share. Hyatt and the California FTB eventually litigated in Nevada and Hyatt was awarded $388 million for the California FTB’s egregious conduct including, intentional infliction of emotional distress and invasion of privacy. While that sounds like a victory, it actually isn’t.

The California FTB has been appealing and delaying the case since then and it is still far from over.

That’s right. To this date, the case has not been resolved. Hyatt may not even receive the judgement in his lifetime.

The point is, that the California FTB will battle you in the courtroom, for what it feels it’s owed, until the end of time.

This isn’t just limited to California. All other state tax boards will aggressively go after taxes they feel they are entitled to.

Will a Nevada Corporation Provide Lawsuit Protection?

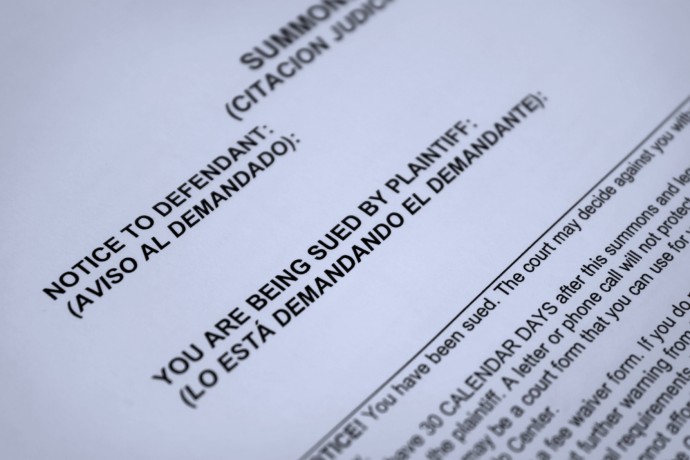

Incorporating in Nevada can leave you personally liable in case of a lawsuit, if your business doesn’t operate in Nevada.

If your corporation is not registered in the state where you conduct business, an out of state corporation will typically not protect you in case of a lawsuit.

Corporations are creatures of state law and are only afforded legal protection in the states they are legally qualified to do business in.

Many business owners who incorporate in Nevada, and operate their business outside of Nevada, carry on their business for years until they are hit with a lawsuit outside of Nevada, leaving them fully exposed.

Corporations that fail to qualify to do business in the state they conduct business out of are also unable to file their own lawsuits or collect amounts owed, via the California court system.

Businesses that fail to qualify to do business in their home state are also subject to penalties and fines.

Additionally, the contracts entered into by these businesses can be voided at the option of the other side of the contracts.

Accordingly, you should not incorporate in Nevada for liability protection if your business is not based out of Nevada. Doing so can be disastrous.

Will Incorporating in Nevada Save Me Money?

Incorporating in Nevada can end up costing you a lot of extra money. Save money and the hassle by forming a corporation in your home state.

If you incorporate in Nevada and your business is not headquartered in Nevada, you will not save on overall costs. The decision to incorporate in Nevada can actually end up costing you even more.

If your business is not based out of Nevada, you must receive authorization to use the Nevada corporation in your state.

For example, a California business that incorporates in Nevada must separately qualify to do business in California. This process takes as much time and can cost as much money as originally forming the corporation in California.

Moreover, you would also need to appoint a corporate agent to receive official notices in the other state — another cost you would have to bear.

Finally, you would also have to pay annual registration fees, franchise taxes and gross receipt taxes (which can easily reach into the thousands) in two different states.

Again, if your business is not based out of Nevada, it’s unlikely that you will save any money with a Nevada corporation. In fact, it will likely cost you much more than incorporating in your home state.

Should I Incorporate in Nevada for More Privacy?

Nevada corporations can sometime provide less privacy than other states.

No. Nevada corporations do not necessarily provide business owners with increased privacy.

One of the major myths is that incorporating in Nevada will provide you with extreme privacy. The reality is that Nevada often provides less privacy than many other states.

A simple Nevada Business Entity Search on the Nevada Secretary of State website will yield information like the name and address of a corporation’s president, secretary and treasurer and a list of all actions and amendments associated with the corporation. A search for a Nevada LLC yields the name and addresses of all managing members.

None of this information is available on the Sec. of State websites of most states, including California. Furthermore, the Sec. of State can easily disclose all information associated with a Nevada corporation or LLC in connection with a lawsuit or subpoena.

Where Should I Incorporate?

You are usually better off incorporating in your home state.

Under most circumstances, you should not incorporate in Nevada unless you conduct business in Nevada. Ultimately, forming a corporation outside your business home state can cause financial and liability issues. If you are a small business, you should typically incorporate in the state you and your business are based out of.

Also remember that your business is responsible for paying taxes in the state where it conducts business, not where you decide to incorporate or form an LLC.

Don’t fall for the lure of tax avoidance. It can come back to haunt you and your business.