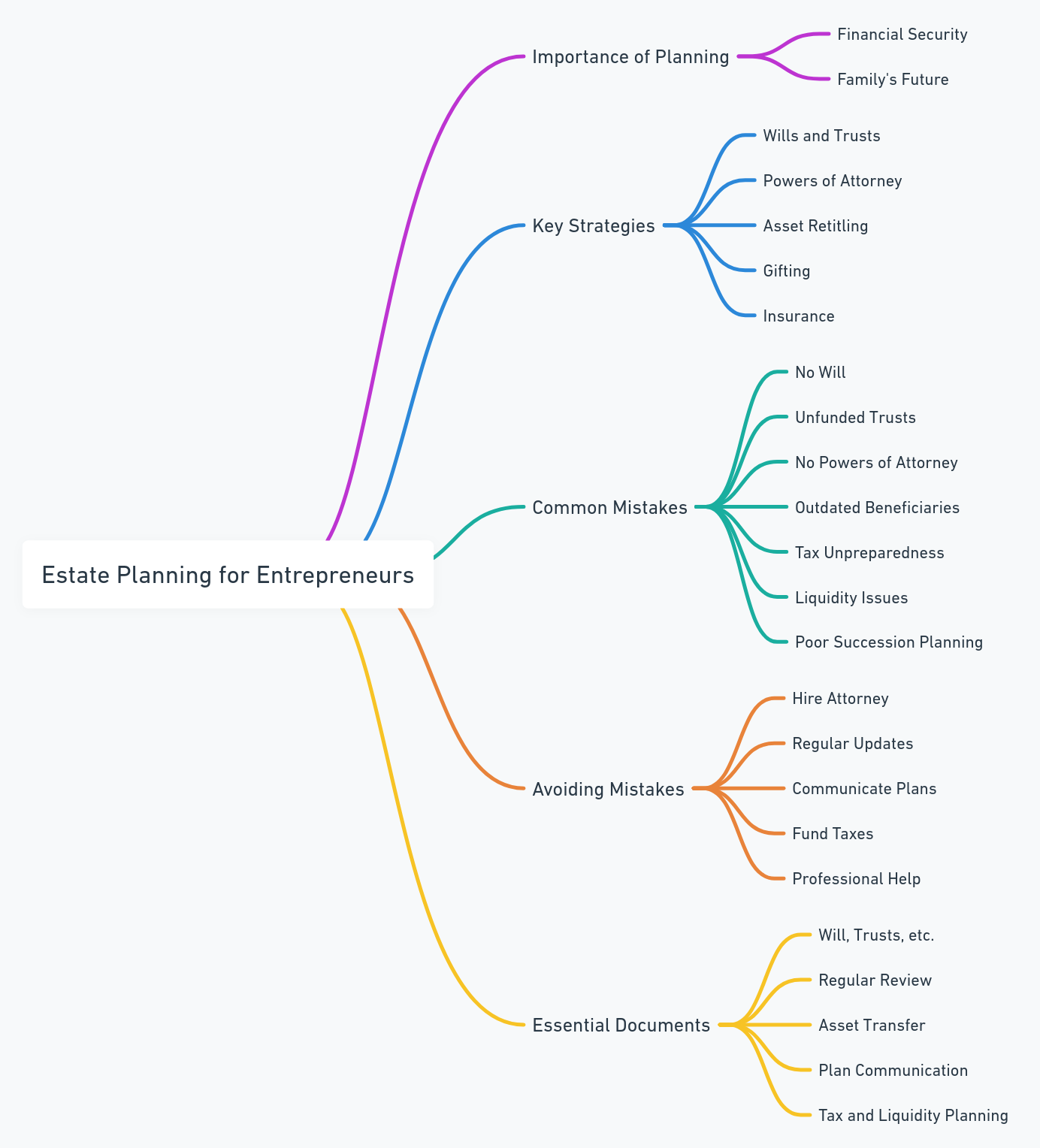

This guide emphasizes the importance of estate planning for entrepreneurs, highlighting common pitfalls and effective strategies to safeguard one's business and family's future. It covers everything from creating wills and trusts to managing estate taxes and succession planning, offering vital insights to protect your legacy and ensure a smooth transition for future generations.

by LawInc Staff

November 27, 2023

As an entrepreneur, you have worked tirelessly to build your business and establish your professional legacy. Protecting what you have created should be a priority not only for your own financial security, but for your family’s future and your enduring impact as a business leader. According to 2021 estimates, over 75% of U.S. business owners do not have any formal estate planning completed.

That is why implementing a smart estate plan is a crucial step all entrepreneurs should take. However, navigating tax laws, preserving business assets, and creating wealth transfer strategies requires specialized legal and financial expertise. The stakes for inaction are high – lack of planning could force liquidation of a life’s work along with significant tax repercussions.

This guide examines common estate planning mistakes entrepreneurs make and how to avoid pitfalls to successfully preserve both your business and family’s futures.

Introduction to Wealth Transfer Concepts

Before examining missteps to avoid, below is a brief overview of key estate planning strategies entrepreneurs employ:

Wills and Trusts – Legal documents outlining asset distribution instructions and naming guardians for dependents in case of death.

Lifetime Powers of Attorney – Authorize designated agents to handle finances and healthcare if one becomes disabled.

Retitling Assets – Transferring various property into trusts so they avoid probate and provide better control mechanisms.

Gifting – Allowed contribution exemptions enable tax-free wealth shifting to heirs during life.

Valuation Discounts – Legitimately reducing estimated business values lowers potential estate taxes.

Insurance – Creates liquidity to pay estate taxes without forcing fire sales of assets.

Now on to missteps to avoid:

1. Not Having a Will

-

- Business Succession: Without a will dictating succession plans, your company could be forcibly sold or closed after you pass away.

- Asset Distribution: Dying intestate triggers court administration of assets per state laws, which may conflict with your wishes.

- Family Protection: Wills enable appointing guardians for minor children and trustees to manage inheritance.

Example:

-

- Mark spent 30 years building his catering company, hoping to pass it to his son one day. But after Mark died suddenly without a will outlining formal succession plans, a long costly legal battle ensued between potential buyers. Without Mark’s clear documented wishes, the business had to be sold to settle his estate instead of staying in the family as intended.

- Amy passed away intestate at age 52 after a short illness, leaving two teenage children and an internet startup business she recently founded. The court appointed an administrator to distribute Amy’s assets per state laws instead of based on her preferences. After estate expenses, Amy’s children inherited a fraction of the value compared to if Amy had crafted a proper will.

How to Avoid:

-

- Hire an estate planning attorney to prepare your will, trusts, etc.

- Outline detailed succession plans for your business.

- Update will regularly, at least every 3-5 years, as your situation evolves.

Frequently Asked Questions:

-

- Can’t I just leave the business to my spouse? Yes, but a will provides legally binding specifics.

- What if I plan to sell my company while living? Consult your attorney to tailor estate plan accordingly.

2. Not Funding Trusts

-

- Avoiding Probate: Transferring assets into your living trust sidesteps court processes after death.

- Wealth Preservation: Trusts provide control mechanisms to responsibly distribute assets to heirs.

- Seamless Transition: Fully funded trusts allow quicker execution of your succession wishes.

Example:

-

- John designated his business successor and outlined a plan of staggered distributions to his heirs in his trust. But after John’s unexpected death, the successor discovered John never transferred business ownership into the trust as intended. This triggered a lengthy probate process subjecting the company operations and assets to court oversight before they could finally transfer according to John’s preferences stated in the will.

- Amy took the right initial step of establishing a revocable living trust with detailed instructions on asset distribution after her death. However, she never re-titled her $2M commercial warehouse into the trust’s name. As a result, the building had to go through probate after Amy died. After 2 years in the courts, the property was finally transferred to Amy’s trust – frustrating her wishes for it to help support her grandchildren immediately after she passed.

How to Avoid:

-

- Work with your lawyer to transfer designated assets into your trust.

- Consult CPAs and valuation pros to coordinate funding.

- Review trust funding annually to update ownership changes.

Frequently Asked Questions:

-

- What assets should I put into my trust? Business interests, significant real estate holdings, other valuable property.

- Is it better for my spouse to inherit my business? Examine tax incentives and succession goals before deciding.

3. Not Having Lifetime Powers of Attorney

-

- Disability Planning: These legal authorizations designate someone to manage your affairs if you become incapacitated.

- Business Continuity: Absent lifetime powers, court oversight would govern your company after disability.

- Avoid Court Process: Allows designated agents to make legal and financial decisions if needed.

Example:

-

- Bill had a stroke at age 65 requiring years of slow rehabilitation. Because he never established legal powers authorizing someone to manage his lucrative furniture outlet, a court conservatorship was required. For 3 years, the court administrator had to approve every business decision – from employee salaries, inventory orders, to contract commitments. Profits suffered during that time from expenses related to court accountings and delays getting approvals. All this could have been avoided if Bill created Powers of Attorney.

- When Laura slipped into a coma after a car accident, her administrative assistant needed Laura’s signature for payroll checks and to renew several supplier agreements. Unfortunately, without legal Power of Attorney documentation, even these routine operational items had to be approved by the courts. It caused serious disruptions until Laura regained competency months later.

How to Avoid:

-

- Establish financial and healthcare powers of attorney with an estate planning lawyer.

- Select agents to serve if you’re ever incapacitated.

- Outline specific powers your agents will hold.

Frequently Asked Questions:

-

- Can my spouse serve as my agent? Yes, but consider also designating a professional as co-agent or successor.

- Can I customize powers granted? Yes, tailor authorities based on capabilities of your selected agents.

4. Not Reviewing Beneficiary Designations

-

- Outdated Elections: Beneficiaries listed on policies and accounts may conflict with current estate plan.

- Unexpected Outcomes: Assets could transfer to unintended recipients if designations aren’t updated.

- Post-Divorce Complications: State laws differ on divorces nullifying beneficiary status.

Example:

-

- When Mark died at age 52, his $1M life insurance policy unexpectedly went to his ex-wife Janice who he divorced 5 years prior but never updated as beneficiary. This contradicted the instructions in Mark’s will leaving all assets to his current wife and children. While in some states divorce revokes ex-spouse rights, the laws were different in Mark’s case – costing his intended heirs a substantial inheritance.

- After her partner Joan passed away, Laura discovered the $100k IRA account Joan left to her would be taxed as ordinary income because Laura was not the original beneficiary. Had Joan coordinated with her estate planning attorney and updated the election when she changed her will to leave the IRA to Laura, the asset could have passed tax-free based on IRS regulations for inherited retirement accounts.

How to Avoid:

-

- Review beneficiaries after major life events – deaths, marriages etc.

- Update designations on insurance policies, accounts accordingly.

- Seek counsel given complex divorce-related designation laws.

Frequently Asked Questions:

-

- Where are beneficiary listings located? Life insurance, 401(k)s, IRAs, pensions, bank/investment accounts.

- What supersedes conflicting designations? Generally, whichever listing was most recently updated.

5. Not Planning for Estate Taxes

-

- Exemption Limits: Estates over $12M+ face federal estate taxes up to 40% – lower thresholds exist in some states.

- Wealth Erosion: Significant assets may have to be liquidated to pay tax bills if unplanned for.

- Survivor Burdens: Heirs left grappling with unanticipated estate tax and financial instability.

Example:

-

- Mark heavily invested business profits back into growing his $15M commercial construction firm, keeping little excess liquid reserves on hand. When Mark passed away unexpectedly, estate taxes of nearly $4M were owed. His heirs struggled to access enough capital to pay the tax liability while retaining control of the business. They ultimately had to sell the company under value due to the timeline pressures – costing the estate over $3M more.

- Laura also concentrated her wealth within her $25M business while living, with minimal savings set aside. After she died, her heirs were shocked to have to pay nearly $8M in estate taxes. As her four children squabbled on how to raise funds while retaining their inheritance intact, prolonged legal disputes resulted – draining over $1M in legal fees alone over 2 years before assets had to be liquidated at a loss.

How to Avoid:

-

- Leverage trusts, gifting, and other strategies to lower taxable estate value.

- Research state exemption limits in addition to federal regs.

- Obtain life insurance to cover potential tax bills.

Frequently Asked Questions:

-

- Are estate taxes only federal? No, certain states also impose substantial estate and inheritance taxes.

- What assets are excluded from estate value? Varies by state, but certain life insurance payouts and retirement accounts may be exempt.

6. Not Planning for Liquidity

-

- Cash Shortfalls: Many estates lack readily accessible cash to pay sizeable tax obligations triggered at death.

- Forced Liquidations: Absent cash reserves, heirs must hastily sell assets under value, often relinquishing control of businesses.

- Insurance Solutions: Policies can inject needed liquidity to satisfy estate tax bills without asset fire sales.

Example:

-

- Stan owned over $20M in real estate but kept little cash or liquid investments. When Stan died unexpectedly, his heirs had to sell 3 apartment buildings for $3M under market value to pay estate taxes quickly before high mandatory penalty interest rates kicked in.

- Oldrich’s $10M aviation parts wholesale business was left to his daughter in his will. But without enough cash set aside to fund the tax obligation triggered at his death, she had to sell the company shares at a 30% discount just to access funds in time.

How to Avoid:

-

- Determine potential estate tax liability via professional assessment.

- Use life insurance policies and liquid savings specifically earmarked for obligations.

- Inform heirs of tax funding plans to ensure seamless execution.

Frequently Asked Questions:

-

- How is an estate’s liquidity requirement calculated? Total tax liability reduced by assets providing immediate cash, such as CDs and money market holdings.

- What policy amount is needed? Enough to pay entire tax obligation, factoring in potential under valuation asset sales.

7. Inadequate Succession Planning

-

- Leadership Continuity: Designate successor management to ensure smooth day-to-day business operations when you exit.

- Ownership Transition: Spell out detailed transfer instructions to heirs for company equity, voting rights, dividends, etc.

- Retain Key Talent: Implement incentives such as deferred compensation and restrictive stock to retain influential employees through transition.

Example:

-

- When the founder of a thriving car dealership passed without documenting succession plans, employees were left directionless. Key personnel resigned soon after, and heirs quarreled over control as revenues spiraled downward.

- A booming house cleaning franchise lost over 80% of its branch network after the owner died without formal leadership and ownership continuity plans in place.

How to Avoid:

-

- Discuss succession goals with management and family in advance.

- Outline contingency plans in your estate documents for seamless execution.

- Provide leadership training and incentives for key next generation successors.

Frequently Asked Questions:

-

- What happens if no leadership successor is named? Courts appoint administrators, often professional third parties, to oversee operations.

- Should succession planning be communicated? Yes, to reassure employees and provide leadership opportunities.

Summary

If reading through all the common mistakes and solutions left you feeling a bit overwhelmed, let’s recap the main points to keep in mind:

- Get essential documents drafted – This means, at minimum, having a will, powers of attorney, funded trusts, etc. to dictate your succession wishes.

- Review and update regularly – Revisit your estate plan at least every 2-3 years as circumstances evolve to avoid assets going to unintended recipients.

- Retitle assets – Transfer ownership of your business, property, and financial account balances into your trust to ease distribution upon death.

- Communicate the plan – Estate planning affects many stakeholders, so ensure your family, business partners, trustees etc. understand the roadmap ahead.

- Fund tax obligations – Optimize planning vehicles to minimize taxes, but have liquidity available through cash reserves and insurance to handle liabilities.

- Get professional help – Work closely with your financial advisor, accountant and estate planning attorney to implement strategies tailored to your vision.

Visual Summary of Estate Planning Essentials for Business Owners

While handing off your estate involves many complex legal and tax considerations, the right plan put in place today can secure your legacy for generations to come. So take action now to protect both your business and your family’s future.

Quiz

Get Professional Help Creating Your California Estate Plan

Contact us to be connected with a local estate planning attorney who can provide customized guidance on protecting your California assets and loved ones.

Disclaimer

The information in this guide relates specifically to California estate planning laws, which can vary significantly from other states. Consult with a local attorney if you do not reside in California.

This guide is for informational purposes only and should not substitute formal legal advice. Estate planning involves complex factors unique to each person’s situation. Work with a qualified local attorney to develop a comprehensive plan tailored to your needs.

Also See