by Sheren Javdan

June 30, 2014

39 year old CEO of GoPro Inc. is now worth billions. Nicholas “Nick” Woodman is now worth $2 Billion as stock prices in his company shot up. GoPro went public on Thursday and during its first day, stocks rose up to 30% from their initial public offering price of $24. Friday, the price per share rose to $35.75/share.

Today, GoPro shares are trading for $40.36/share, rising more than 13% since the company first went public three days ago. GoPro stock is now trading at almost 70% over its initial public offering (IPO).

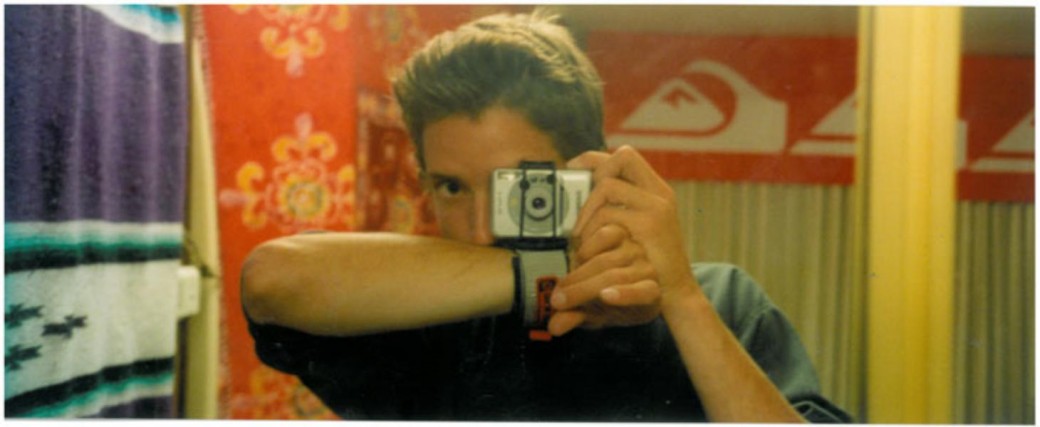

Woodman seen here with prototype camera and wrist strap in 2001

Woodman first developed his love for surfing as a high school senior. To document his surfing, Woodman used surfboard leashes and rubber bands to attach existing cameras to his wrists. The original GoPro concept camera captured action shots in the water. In 2001, after failing with a dot-com company, Woodman took a surf trip to Australia and Indonesia that changed his career.

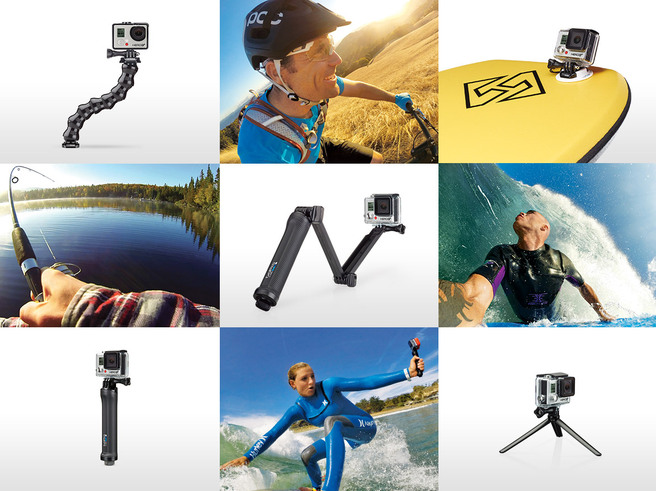

Woodman documented his trip with the GoPro and after returning home decided to sell the wrist strap, camera and casing as an all-in-one package. By 2007 the company brought in $3.4 million. Today, the company produces and sells wearable cameras used by surfers, skydivers, motorists and anyone else to record and post their adventures online.

Woodman, the company’s young founder, has benefited the most from the IPO. Woodman sold approximately 3.6 million shares in the IPO, generating a pretax windfall of $86 million. Woodman however, still owns over 52 million Class B shares of stock in the company, giving the young billionaire a 48% voting stake. In addition, at the time of the IPO, Woodman’s stake in GoPro was worth $1.2 billion.

Today, according to Forbes, Woodman’s current stake in the company is worth $2.3 billion as the company’s stocks continue to increase.

Dean Woodman, Woodman’s father and prominent Silicon Valley investment banker, provided the young entrepreneur $200,000 seed capital when the startup company started. Dean’s contribution to the company has now made him a multi-millionare, as his post IPO stake in the company is worth approximately $280 million. Dean, who did not sell any of his shares in the IPO, now has a 140,000% return on his investment.

Another investor benefiting from the increased rise of stock prices in the startup is Foxconn Technology Co Ltd. The Chinese electronics manufacturing company owns 11 million shares in GoPro, equating to $425 million. That is a huge return on their initial investment of $200 million.

Another company benefiting from the company’s fruits of labor is private equity firm Riverwood Capital. The company owns a stake in GoPro worth approximately $650 million.

Topics: IPO, Small Business, Startups