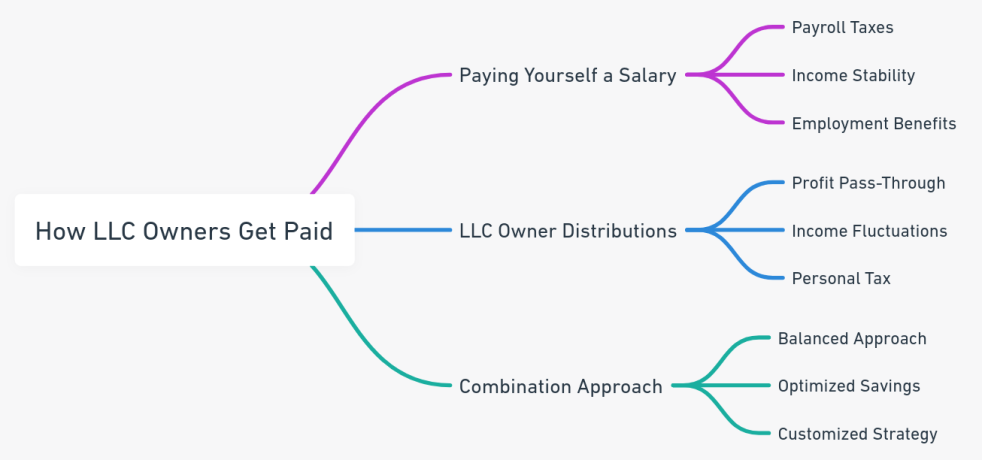

Discover the most effective ways for LLC owners to pay themselves, balancing salaries, distributions, and combined methods for tax efficiency and financial stability. This guide provides insights into the pros and cons of each approach, helping owners make informed decisions for their unique business needs.

by LawInc Staff

November 24, 2023

As a limited liability company (LLC) owner, determining how to pay yourself appropriately involves key considerations around taxes, liability protection, and financial planning.

With multiple options available, what is the optimal payment strategy for your situation?

This guide examines the most common ways LLC owners pay themselves, including the pros and cons of each approach. We also explore important factors that impact payout decisions, FAQs, and professional guidance to safeguard your interests.

1. Paying Yourself a Salary

Understanding the Salary Payment Structure for LLC Owners

-

- Payroll Taxes: Salaries are subject to Medicare, Social Security, and federal/state payroll taxes.

- Income Stability: Provides predictable, steady earned income distributed regularly.

- Employment Benefits: May qualify for unemployment, disability insurance, etc. based on salary income.

Example:

-

- Jenny takes $60,000 salary from her LLC annually, paying regular payroll taxes on the income.

How to Implement:

-

- For LLCs taxed as corporations, formally establish yourself as an employee of your LLC. Note: Single-member LLCs or those taxed as partnerships cannot pay salaries to owners in the traditional sense; they take draws instead.

- Process payroll regularly via payroll service or self-administration.

- Pay applicable income, payroll, unemployment and disability taxes.

Frequently Asked Questions:

-

- What is an appropriate LLC owner salary amount? Depends on compensation levels in your industry & responsibilities.

- Does owner salary impact my business taxes? Yes, salaries are deductible business expenses reducing LLC income/tax liability.

2. LLC Owner Distributions

Key Elements of Profit Distributions for LLC Owners

-

-

- Profit Pass-Through: Earnings from single-member LLCs and multi-member LLCs taxed as partnerships pass through to owners. These profits are subject to self-employment tax, which includes Social Security and Medicare taxes, similar to payroll taxes. However, unlike traditional employee salaries, these distributions are not subject to separate withholding for payroll taxes.

- Income Fluctuations: The amount of distributions can significantly fluctuate based on the profitability of the LLC. This variability highlights the need for careful financial planning for LLC owners.

- Personal Tax: The distributed profits are taxed at the personal income tax rates of the owners. While these distributions avoid the double taxation inherent in traditional corporate structures (where profits are taxed at both the corporate and personal levels), owners should be aware that their total tax liability may vary based on their individual tax situations.

-

Example:

-

- Bob takes owner draws throughout the year based on LLC profitability, paying personal income tax.

How to Implement:

-

- Carefully determine amount and timing of distributions based on cash flow needs.

- Record owner draws correctly for accurate financial statements and tax returns.

- Save for personal tax payments to avoid underpayment penalties.

Frequently Asked Questions:

-

- Can I take flexible owner draws throughout the year? Yes, you control distribution timing/amounts.

- Are LLC owner distributions guaranteed? No, depends entirely on profit levels each year.

3. Combination Approach

Integrating Salary and Distributions for Effective LLC Owner Payment

-

- Balanced Approach: For LLCs taxed as an S corporation, a blend of reasonable salary income (subject to IRS guidelines) plus flexible distribution payouts from profits can optimize tax savings.

- Optimized Savings: Balance salary amount and deductions to maximize retirement plan contributions.

- Customized Strategy: Can tailor salary, distribution, and investment levels yearly to meet changing business and personal finances.

Example:

-

- Steve takes a $75,000 salary from his LLC, plus quarterly distributions based on profit.

How to Implement:

-

- Set reasonable base salary aligned with value provided and industry norms.

- Review salary and distribution needs annually based on business income and tax situation.

- Adjust combination as personal or business finances change over time.

Frequently Asked Questions:

-

- Can salary and distributions be taken simultaneously? Yes, many LLC owners pay themselves using both approaches.

- Should I take salary, distributions or both? Depends on goals, taxes, and liability; combination allows optimizing both.

Summary

As an LLC owner, how you pay yourself requires aligning compensation with value provided, aiming for sufficient income stability, optimizing taxes, and maintaining liability protection. The right payout strategy can evolve over time alongside changes in profitability, tax situation, and business goals.

Exploring Payment Options for LLC Owners

By understanding the tradeoffs around salaries, distributions, retirement savings, self-employment taxes, and personal income tax rates, LLC owners can develop both short and long-term payment plans that suit their needs.

Quiz

Quiz: How to Pay Yourself as an LLC Owner

-

- Q1: For LLCs taxed as corporations, owner salaries require payment of: A) Personal taxes B) Corporate taxes C) Payroll taxes. Note: Single-member LLCs and partnerships cannot pay traditional salaries.

- Q2: LLC profit pass-through via distributions avoids: A) Double taxation B) Payroll taxes C) Personal taxes

- Q3: Combining salary and distributions allows: A) Tax optimization B) Retirement savings C) Income stability

- Q4: LLC ownership distributions are: A) Regular guaranteed income B) Aligned with profits C) Subject to payroll taxes

- Q5: Reasonable LLC owner salaries should align with: A) Personal living expenses B) Industry standards C) Corporate tax rates

- Q6: Fluctuating LLC distribution amounts reflect: A) Owner contributions B) Business profits C) Salary deductions

Answers: Q1: C) Payroll taxes Q2: B) Payroll taxes Q3: A) Tax optimization Q4: B) Aligned with profits Q5: B) Industry standards Q6: B) Business profits

Need Help Forming an LLC?

Need help forming an LLC? To get the process, simply complete our secure online application.

Need Other Legal Help?

Contact us to get connected with lawyers in any other field of law you might need help with.

Disclaimer:

The information in this guide relates specifically to U.S. federal tax regulations, with emphasis on the differences in tax treatment based on whether an LLC is taxed as a sole proprietorship, partnership, or corporation. Specific rules can vary by state. Consult a licensed tax professional or attorney to understand how your state and situation may impact your optimal payout approach.

This guide presents general information only and should not substitute personalized advice from qualified professionals. As every business and owner’s financial goals are unique, you should seek bespoke counsel on your LLC compensation strategies.

Also See