Managing a medical corporation in California requires careful attention to legal details and operational practices. This guide outlines crucial steps for medical professionals, including maintaining proper records, choosing the right business structure, securing necessary licenses, and managing finances effectively to avoid legal troubles and ensure efficient operation.

by LawInc Staff

November 26, 2023

Forming and operating a professional medical corporation (PC) in California provides many potential advantages in limiting liability and optimizing tax benefits. However, navigating corporate formalities also carries legal risks if certain regulatory complexities get mismanaged.

Being aware of and steering clear of the most common legal mistakes is key to successfully establishing and running your California medical corp.

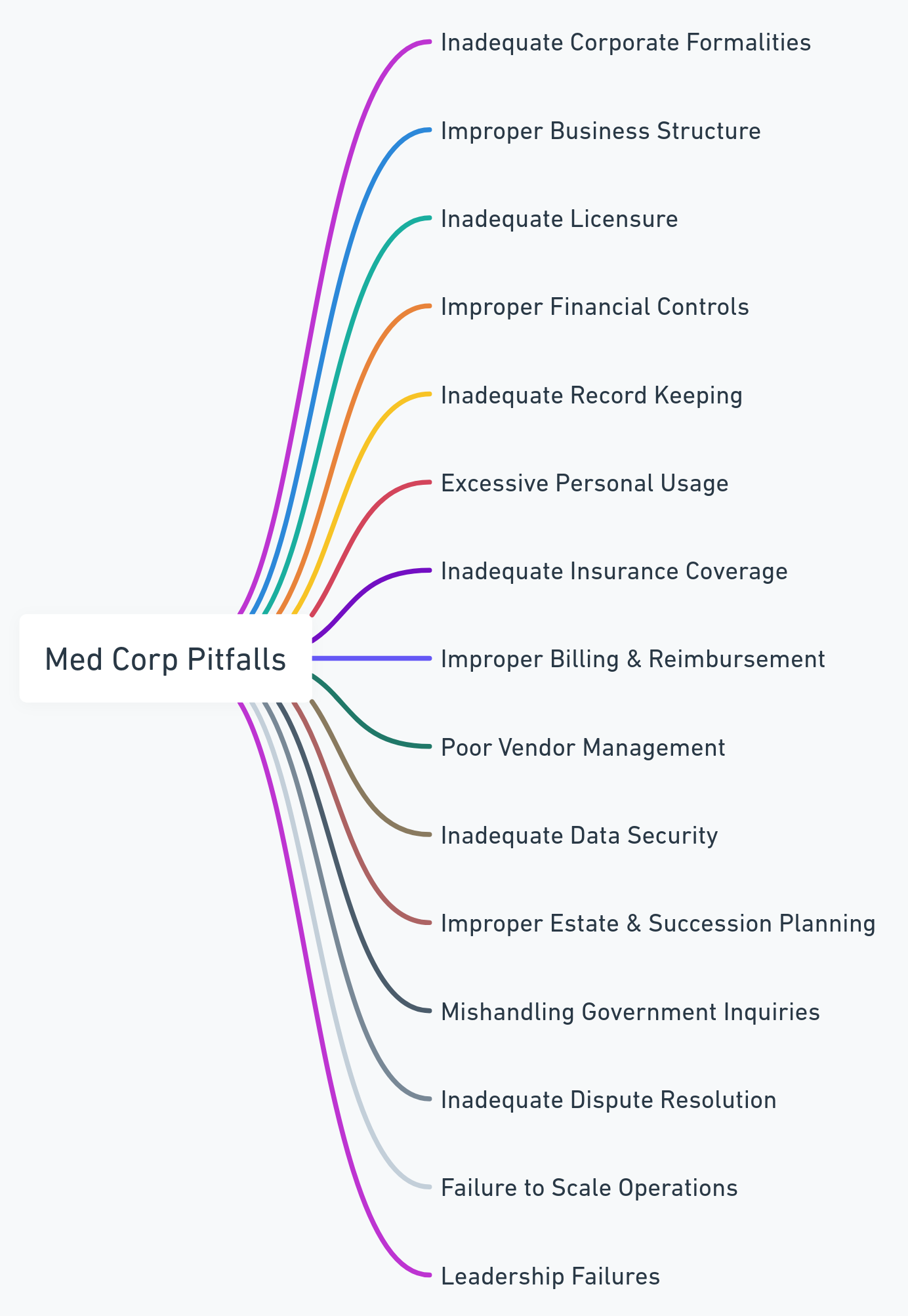

This guide outlines 15 pitfalls to avoid when incorporating and managing a professional medical corporation in the state.

1. Inadequate Corporate Formalities

-

- Annual Requirements: Must file statement of information, hold annual meetings, keep records, and more.

- Piercing the Corporate Veil: Disregard of formalities risks personal liability for the professional.

- Document Diligently: Carefully maintain meeting minutes, corporate records, filings, and valid insurance.

Example:

-

- Dr. Adams faced personal liability for a patient lawsuit because his medical corporation failed to follow formalities.

How to Avoid:

-

- Maintain detailed records of meetings, policies, stock issuances and other formalities.

- Strictly separate personal and corporate finances.

- Work closely with legal counsel to ensure full compliance.

Frequently Asked Questions:

-

- What are examples of key corporate formalities? Holding valid meetings, issuing stock certificates (with the specific language required for medical corporations), filing annual reports, documenting policies.

- What happens if corporate veil is pierced? The professional loses liability protection and can face personal responsibility for lawsuits or debts.

2. Improper Business Structure

-

- Know the Options: C corporations and S corporations – each structure has pros and cons to evaluate.

- Professional Guidance: Business lawyers help determine the best fit based on liability, taxes, operations and other factors.

- Custom Strategy: The optimal business structure can depend on the professional services offered.

Example:

-

- Dr. Lee’s C corporation lacked the tax savings he would have received with an S corporation.

How to Avoid:

-

- Consult business attorneys and financial advisors to determine optimal structure.

- Consider long-term goals and business needs beyond just taxes.

- Be willing to convert to a more suitable entity in the future if necessary.

Frequently Asked Questions:

-

- What factors determine the best professional corporation structure? Limiting personal liability, business continuity needs, optimizing taxes, professional category, and more.

- Can I easily change tax status later on? Yes, you can convert, but the process can get complex on the backend.

3. Inadequate Licensure

-

- Regulatory Compliance: Failure to obtain required professional licenses can lead to regulatory action.

- Safety Risks: Practicing without licenses puts clients at risk and increases liability exposure.

- Insurance Barriers: Many policies require maintaining valid professional credentials.

Example:

-

- Dr. Patel’s medical corporation was fined for allowing unlicensed staff to treat patients.

How to Avoid:

-

- Verify all required licenses and credentials before commencing services.

- Establish strict policies for vetting staff qualifications.

- Consult legal counsel regarding professional regulatory requirements.

Frequently Asked Questions:

-

- Can my corporation lose its ability to operate if licenses lapse? Yes, failure to maintain valid professional credentials can halt legal authority.

- How often must I renew my professional licenses? Requirements vary by state and profession – verify renewal terms to remain compliant.

4. Improper Financial Controls

-

- Fraud Risks: Absence of financial oversight makes misappropriation of funds more likely.

- Tax Issues: Improper documentation can result in rejected deductions and penalties during IRS audits.

- Financial Health: Lack of accurate tracking can obscure struggling operations and cash flow issues.

Example:

-

- Dr. Andrews failed to detect his CFO had embezzled over $100,000 lacking financial oversight.

How to Avoid:

-

- Implement layered internal controls with checks and balances.

- Conduct regular financial audits by independent CPAs.

- Monitor bank statements to quickly catch unauthorized transactions.

Frequently Asked Questions:

-

- Should I require multiple signatures on large financial transactions? Yes, dual authorization helps deter fraud and errors involving material sums.

- What are examples of other useful financial controls? Physical asset security protocols, electronic access controls, transaction pre-approvals, invoice verification processes.

5. Inadequate Record Keeping

-

- Tax Issues: Inadequate documentation risks rejected filings and penalties during IRS audits.

- Legal Disputes: Poor records make defending against lawsuits more difficult.

- Regulatory Scrutiny: Inability to produce required paperwork upon request can lead to fines or revoked licenses.

Example:

-

- Dr. Thompson struggled to dispute a malpractice claim lacking detailed patient records.

How to Avoid:

-

- Implement document management systems with version controls.

- Digitize records while maintaining secure backups.

- Develop retention policies aligned to regulatory statutes of limitation.

Frequently Asked Questions:

-

- What corporate records require permanent retention? Articles of incorporation, bylaws, tax filings, contracts, insurance, board minutes and resolutions.

- What records can I discard after a set period? Employment applications, accounting source documents, expired licenses and non-binding correspondence.

6. Excessive Personal Usage

-

- Tax Issues: Heavy personal expenses paid through the corporation risks added IRS scrutiny and rejection of deductions.

- Legal Exposure: Blurring personal and corporate finances makes the entity vulnerable in lawsuits.

- Financial Drain: Diverting corporate resources for personal gain can severely impact operations.

Example:

-

- Dr. Kelly’s lavish vacations paid by her medical corporation triggered an audit resulting in over $50,000 in back taxes and penalties.

How to Avoid:

-

- Clearly define policies restricting personal usage of corporate resources.

- Ensure accurate expense reporting and reimbursement processes.

- Consult tax experts regarding deductibility of fringe benefits.

Frequently Asked Questions:

-

- What are examples of prohibited personal usage? Vacations, vehicles, home renovations, country club memberships – if paid by the corporation.

- Can I ever use corporate resources for personal matters? Occasional minor usage may be acceptable but should be strictly limited.

7. Inadequate Insurance Coverage

-

- Balance Sheet Protection: Inadequate policies put corporate and personal assets at risk in claims.

- Business Continuity: Gaps may disrupt operations and revenue after accidents or natural disasters.

- Regulatory Mandates: Some professions require specific policy types and limits to maintain licenses..

Example:

-

- Dr. Wilson faced major losses after a fire wasn’t fully covered by his corporation’s property insurance.

How to Avoid:

-

- Engage brokers to conduct risk analyses and secure adequate overall coverage.

- Review policies annually and adjust limits to match growth.

- Ensure compliance with updated regulatory policies.

Frequently Asked Questions:

-

- What main policy types should a professional corporation carry? General liability, medical/professional malpractice, Directors & Officers (D&O), Cyber and Data Privacy, Workers Compensation.

- Should we insure corporate records and data assets? Yes, consult brokers regarding Cyber and Data Privacy policies to cover digitized materials and intellectual property.

8. Improper Billing & Reimbursement

-

- Fraud Risks: Inaccurate claims or coding errors make allegations of false billing more likely.

- Fee Recovery: Improper documentation risks claim rejection and cash flow disruptions.

- Compliance Mandates: Rigorous protocols must safeguard billing to avoid steep regulatory fines.

Example:

-

- Dr. Patel’s clinic lost its Medicare eligibility over high volumes of denied claims.

How to Avoid:

-

- Implement billing systems with rigorous internal controls and staff training.

- Conduct regular external audits to verify full compliance.

- Keep protocols current as regulations frequently update.

Frequently Asked Questions:

-

- Can minor billing errors trigger serious consequences? Yes, regulators and insurance plans take compliance very seriously – even small infractions can prompt investigations.

- What are high risk areas of non-compliance? Billing for services not provided, duplicate claims, inflated costs, coding manipulations, eligibility fraud.

9. Poor Vendor Management

-

- Financial Exposure: Poorly vetted vendors increase risks of fraud, errors, bankruptcies and service disruptions.

- Compliance Diffusion: Lacking vendor oversight makes it easier to bypass protocols causing systemic issues.

- Patient Risks: Subpar quality or negligence by external service providers increases liability.

Example:

-

- Dr. Roberts’ clinic faced lawsuits over unqualified technicians contracted from a third-party lab vendor.

How to Avoid:

-

- Vet all vendors thoroughly upfront and implement performance metrics.

- Mandate compliance with policies and procedures.

- Conduct regular vendor reviews and reassess relationships periodically.

Frequently Asked Questions:

-

- What due diligence is recommended on vendors? Background checks, reference checks, financial vetting, verifying licenses, interviewing principals, reviewing policies and procedures.

- Should vendors carry their own insurance? Yes, validate policies and add your entity as an additional insured to transfer risks.

10. Inadequate Data Security

-

- Reputational Harm: Data breaches erode patient trust and referral volumes.

- Fines & Lawsuits: Non-compliance with constantly evolving privacy regulations carries steep financial risks.

- Business Disruption: Successfully attacking systems and data can severely impact operations.

Example:

-

- Lax security enabled hackers to access thousands of patient records at Dr. Taylor’s clinic, prompting lawsuits.

How to Avoid:

-

- Conduct exposure assessments and implement layered cyber defenses.

- Encrypt data and control access with strict protocols.

- Provide regular end-user security training.

Frequently Asked Questions:

-

- Should I hire external experts to evaluate risks? Yes, independent cybersecurity firms help objectively assess vulnerabilities.

- How often should risk assessments occur? Annually at minimum, but continuous monitoring is ideal to keep pace with constant external threats.

11. Improper Estate & Succession Planning

-

- Business Disruption: Lacking continuity protocols risks destabilization, value erosion and patient losses.

- Conflicts & Court Intervention: Unclear succession can prompt messy disputes over control and equity ownership.

- Tax Consequences: Failure to implement estate strategies results in lost wealth transfers to heirs.

Example:

-

- Absent estate planning, Dr. Miller’s unexpected passing prompted major disputes over practice ownership among children.

How to Avoid:

-

- Implement Buy-Sell Agreements dictating future control transfers.

- Secure life insurance to fund obligations under such agreements.

- Review estate documents routinely to update executors and beneficiary designations.

Frequently Asked Questions:

-

- What assets require special estate planning guidance? Closely held corporate stock, alternative investments, intellectual property rights, specialty licenses.

- What happens if I gift partial ownership before death? Review implications for basis step up, gift taxes, continuity planning, buy-sell triggers, and more.

12. Mishandling Government Inquiries

-

- Criminal Exposure: How a corporation responds to government inquiries can significantly impact outcomes.

- Mitigating Penalties: Mishandling audits or investigations heightens financial and legal repercussions.

- Reputational Harm: Appearing uncooperative with regulators generates suspicion and undermines public trust.

Example:

-

- Dr. Anderson prompted an expanded investigation and potential charges by responding aggressively to initial Medicare audit inquiries.

How to Avoid:

-

- Engage legal counsel promptly when contacted regarding an investigation.

- Conduct internal reviews to understand relevant risks and formulate responses.

- Closely coordinate with counsel before producing documents or communications.

Frequently Asked Questions:

-

- When are external investigations typically launched? Whistleblower complaints, referrals from other agencies, paid informant tips, routine audit findings.

- What agencies commonly investigate medical corporations? DOJ, OIG, FBI, DEA, IRS, FinCEN, Medicare, Medicaid, FDA, professional licensing boards.

13. Inadequate Dispute Resolution

-

- Court Exposure: Mishandling disputes risks suboptimal rulings, unfavorable precedents and reputation damage.

- Settlement Tail Risk: Resolving cases too quickly without understanding long term obligations can backfire.

- Drain on Operations: Prolonged conflicts divert leadership resources and undermine productivity.

Example:

-

- Dr. Martin’s decision not to appeal a disputed licensing board sanction had long term impacts on her reputation and practice.

How to Avoid:

-

- Engage counsel early to carefully assess risks in disputes.

- Consider negotiations and mediation before litigation.

- Model potential settlement impacts over long horizons.

Frequently Asked Questions:

-

- What types of agreements typically require legal review? Settlements, equity/asset sales, partnership agreements, affiliated party deals, leases.

- When should I consider litigation over a dispute? Attempt other resolution paths first, then litigate strategically understanding the time/cost commitment required.

14. Failure to Scale Operations

-

- Stifled Potential: Failing to plan adequately for expansion risks missing growth opportunities.

- Declining Quality: Outpacing capabilities in patient volumes, staffing or facilities strains quality.

- Crisis Management: Reactive vs proactive scaling often forces sub-optimal decisions on financing and operations.

Example:

-

- Rapid expansion left Dr. Davis without adequate staff and resources to meet patient demand without quality declines..

How to Avoid:

-

- Develop long term strategic growth plan supported by financial modeling.

- Secure access to sufficient capital to fund growth.

- Routinely assess need to enhance management, operations and governance.

Frequently Asked Questions:

-

- What indicators highlight needs for additional infrastructure? Patient cycle times, medical errors, customer satisfaction surveys, staff workload scores.

- What are options for financing growth plans? Retained earnings, bank debt, private equity, joint ventures, sale-leasebacks.

15. Leadership Failures

-

- Misaligned Incentives: Conflicts between clinical and administrative priorities commonly undermine cohesive strategy.

- Inadequate Compliance: Physician detachment from operations enables systemic administrative non-compliance.

- Insufficient Accountability: Absent oversight and performance management compromises continuity planning.

Example:

-

- As CEO, Dr. Jones’ lack of leadership generated deep rifts between physicians and the administration.

How to Avoid:

-

- Elect knowledgeable, engaged directors to provide oversight.

- Implement incentives promoting strategy alignment across stakeholders.

- Routinely verify senior management has sufficient skills and direction.

Frequently Asked Questions:

-

- What are warning signs of leadership gaps? Declining productivity, high employee/partner turnover, patient dissatisfaction, increased errors.

- How can physicians improve governance engagement? Assign dedicated time for strategy immersion, provide operational transparency, host board education sessions.

Summary

While incorporating brings many advantages, physicians must invest significant time in governance and strategic planning to avoid legal pitfalls. Insufficient preparation risks personal liability, financial penalties, regulatory actions, reputational damage and operational instability.

Overview of key challenges in managing a medical corporation

We hope this guide provided useful grounding on key areas to address when forming or scaling a professional corporation, including implementing disciplined financial controls, staying compliant as regulations evolve, managing risk proactively and planning deliberately for long term continuity.

Quiz

Common Legal Mistakes Physicians Make with Professional Medical Corporations

Q1: Failing to issue stock certificates and hold meetings risks: A) Tax benefits B) Personal liability C) Cost savings

Q2: Reimbursing lavish personal expenses from the PC risks: A) Inquiry B) Taxes C) Refunds

Q3: Practicing without proper licensure: A) Increases revenues B) Lowers insurance costs C) Heightens liability

Q4: Poor vendor management chiefly increases risks of: A) Lawsuits B) Errors C) Bankruptcy

Q5: Inadequate data security can prompt: A) System failures B) Legal disputes C) Breaches

Q6: Succeeding without continuity planning risks: A) Lower taxes B) Ownership conflicts C) Smooth transition

Q7: Record retention gaps can increase odds of: A) Legal wins B) Settlements C) Malpractice claims

Q8: What is the chief risk of poor physician governance? A) Financial growth B) Staff loyalty C) Non-compliance

Q9: Inability to scale heightens risk of: A) Divestitures B) Site closures C) Declining quality

Q10: Rushing dispute resolution risks: A) Missed details B) swift justice C) Equal outcomes

Answers: Q1: B) Personal liability Q2: A) Inquiry Q3: C) Heightens liability Q4: A) Lawsuits Q5: C) Breaches Q6: B) Ownership conflicts Q7: C) Malpractice claims Q8: C) Non-compliance Q9: C) Declining quality Q10: A) Missed details

Need to Form a Medical Corporation in California?

Contact us to discuss forming a medical professional corporation, ongoing compliance needs, succession planning or other practice legal strategy assistance.

Need Legal Support?

Contact us to discuss ongoing compliance needs, succession planning or other practice legal strategy assistance.

Also See