Business

Learn all about starting, protecting and growing a business with the legal experts at LawInc.

RECENT ARTICLES

The FTC's Review Rule Bombshell: Kiss Your Fake Followers and Reviews Goodbye or Face the Legal Consequences

August 16, 2024 12:08 pm by LawInc Staff

The FTC’s new rule on the use of consumer reviews and testimonials aims to crack down on deceptive practices involving fake reviews, undisclosed paid endorsements, and review suppression. Understanding the...

The Solopreneur's Dilemma: When to Level Up from Sole Proprietor to California S Corp

August 09, 2024 02:08 pm by LawInc Staff

As a California solopreneur, you’ve poured everything into building your business. But as your business grows, you are probably considering whether it’s time to upgrade from a sole proprietorship to...

The Reasonable Salary Requirement: Mastering Compensation Rules for S Corp Owners

August 01, 2024 05:08 pm by Zach Javdan

Determining a “reasonable salary” is a key requirement for owners of S corporations looking to stay compliant with IRS rules and avoid costly penalties. But mastering the complex guidelines on...

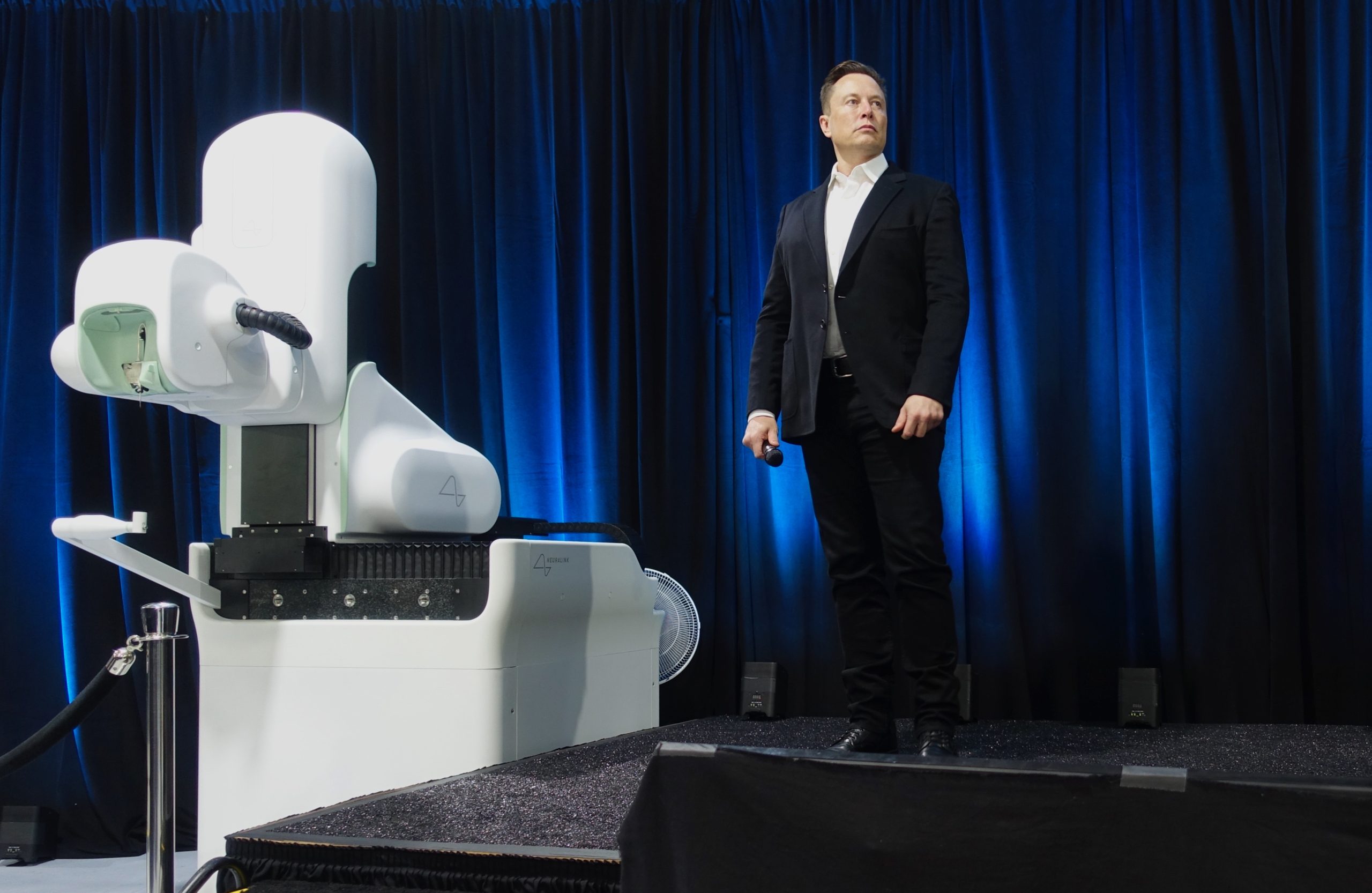

One Musk to Rule Them All: The Antitrust & Governance Gauntlet Facing a Unified Elon Empire

July 25, 2024 10:07 am by LawInc Staff

In a recent tweet, TED head Chris Anderson made a bold suggestion to Elon Musk: consolidate all of his various companies (Tesla, SpaceX, Twitter/X, Neuralink, Boring Co.) into a single...

The Entrepreneur's Blueprint: Setting Up and Running Your California LLC or S-Corp

June 27, 2024 07:06 pm by Zach Javdan

Starting a small business in California as an LLC or S-Corp can offer liability protection and tax advantages, but maneuvering through the formation and management process can be complex. This...

Celebrity LLC vs. Loan-Out Corporation: The Ultimate Guide

June 22, 2024 09:06 am by Zach Javdan

Celebrities, entertainers, and high-profile individuals often use legal business entities to manage their income, protect their assets, and optimize their tax strategy. Two popular options are the LLC (Limited Liability...

Small Business Lawsuit Survival Guide: 10 Bulletproof Strategies to Keep Your Company Safe

June 10, 2024 04:06 pm by LawInc Staff

Lawsuits pose existential threats to small businesses lacking robust legal defense strategies. This guide outlines ten core strategies uniting how California’s sharpest business attorneys safeguard companies against litigation. Need assistance protecting...

The Employer’s Shield: Creating a Legally Safe Workplace

May 30, 2024 12:05 pm by LawInc Staff

In today’s litigious business environment, guarding against legal pitfalls proves paramount for safeguarding organizational wellbeing. Employment law complexities expose unwitting companies to myriad risks – costly lawsuits, damaged reputations, weakened...

Starting a Business in Los Angeles? 10 Essential Legal Steps to Protect Yourself and Your Business

May 24, 2024 02:05 pm by LawInc Staff

Launching a new venture in Los Angeles opens doors to immense opportunities yet also carries complex legal responsibilities. Savvy entrepreneurs recognize that investing in essential legal groundwork from the outset...

The Entrepreneur’s Legal Survival Guide: From Idea to IPO

May 22, 2024 12:05 pm by LawInc Staff

Starting a business and growing it into a successful enterprise ready for an Initial Public Offering (IPO) requires navigating a complex legal landscape. Key legal considerations arise at each stage...