California law corporations provide many benefits to attorneys looking to save on taxes and receive additional liability protection.

by Zach Javdan

December 18, 2022

Are you a California attorney, with your own law practice, looking for tax savings and to help limit your liability? If so, consider forming a California professional corporation. Specifically a California law corporation.

By having your law corporation taxed pursuant to subchapter S of the Internal Revenue Code (taxed as an S corporation), you could be eligible for significant payroll tax savings.

Other benefits of forming a CA law corporation include continuity and business credibility.

While a law corporation will not limit your exposure for malpractice, it can be helpful for other types of lawsuits. Examples include claims by employees and contractual disputes.

Be sure to consider the following factors when starting a law corporation in California. Failure to do so could lead to invalidation of the entity in case of a lawsuit or audit.

Consult with a California Business Formation Attorney

A lot of attorneys take the do-it-yourself to forming a law corporation.

This often leads to hiccups during the registration process since most attorneys are not familiar with the paperwork required to make the corporation valid when registering it with the State Bar of California.

Use your time wisely and delegate responsibility to a California business law formation attorney so you can ensure everything is done correctly.

Also make sure the attorney you work with has specific experience with forming corporations for lawyers.

Be sure to discuss things like formalities, liability issues, tax questions, timing, and more.

If you would like to have your entity formed by a California business formation attorney, simply call us at (310) 765-2525 or securely get the process started online.

When to Form a Professional Corporation in California

Is it better to wait until the new year if you are forming a law corporation in November?

Should I form my law corporation during the last 15 days of the year, for tax benefits?

Questions like these are important to consider and discuss with the business law specialist you work with.

California Lawyers Cannot Practice Law Using an LLC

Simply put, attorneys cannot practice law, using an LLC, pursuant to California Corporations Code §17375.

This statute prohibits lawyers, and most other licensed professionals, to use a Limited Liability Company (LLC) in connection with their license.

Lawyers must specifically use professional law corporations which are certified by the California Secretary of State and registered with the California State Bar.

Are you Eligible to Form a California Law Corporation?

Ensure that all of the officers, directors and shareholders (owners) of the law corporation are licensed to practice law in the State of California.

California Corporations Code section 13403 dictates that when a law corporation has one shareholder, that shareholder shall be the director, president and treasurer of the corporation.

When a law corporation has two shareholders, the shareholders shall be the directors and, among them, hold the positions of president, vice president, secretary and treasurer of the corporation.

California Law Corporations with More than One Owner Should Have a Buy-Sell Agreement

Buy-Sell agreements (also known as shareholder agreements) are critical when a law corporation has more than one shareholder.

Such agreements account for things like what happens to when a shareholder dies, is incapacitated, divorces or decides to sell their shares to another lawyer.

Failure to prepare a buy-sell agreement can be crippling when unforeseen circumstances arise.

A California business formation attorney can help draft a buy-sell agreement for your California law corporation.

Determine Whether a C or S Corporation is Better

California professional law corporations can be taxed two ways.

The first option, which is the default tax classification, is to be taxed as a “C” corporation.

Option two is to be taxed as an “S” corporation.

The C corporation and S corporation designations are made with the IRS, while the law corporation, itself, is formed with the California Secretary of State.

The first step is to file with the CA Sec. of State.

The second step is to file with the IRS.

If IRS Form 2553 is filed with the IRS, the law corporation is treated as a “small business corporation” which is also known as an S Corporation.

C corporations are classified as separate entities for tax purposes.

Accordingly, the C corporation files its own tax return and pays its own income taxes.

In turn, the law corporation’s shareholders (owners) file their own and separate tax returns, which corresponds to income the corporation pays to them, in an individual capacity.

This results in what is commonly referred to as “double taxation.”

California law corporation owners typically prefer to have their corporations taxed as “S” corporations in order to avoid the double taxation associated with C corporations.

S corporations are subject to what is known as “pass-through” taxation.

S corporation tax status is usually preferred by accountants for payroll tax savings, and avoidance of double taxation, but be sure to consult with your own accountant regarding whether a C or S corporation is best for your law practice.

Naming a California Professional Law Corporation

Make sure the law corporation name you choose is available with the CA Sec. of State.

The law corporation name is the only name the entity can practice law under. The State Bar of California does not allow law corporations to use DBAs.

If you would like to use the word “Group” in your professional corporation name, Rule 1-400 of the California Rules of Professional Conduct requires that you justify use of the word by naming at least one other individual employed by the corporation who need not be an attorney.

If you would like to use the term “Law Offices” in the corporation name, you must provide the State Bar with two business addresses, one of which can be your home address.

If you would like to use the term “Associate” in the corporation name, you must have one (1) other employee, in addition to the shareholder.

If you would like to use the term “Associates” in the corporation name, you must have two (2) other employees, in addition to the shareholder.

Permissible law corporation name endings include: Incorporated, Inc., Corporation, Corp., A Professional Corporation, A Professional Law Corporation, Professional Corporation, Professional Law Corporation, Law Corporation, APC, A.P.C., PC, P.C., Prof. Corp., A Professional Legal Corporation, Professional Legal Corporation, A Legal Corporation, Inc., A California Professional Corporation, L.C., Ltd., Limited, P.A., and Professional Association.

Determine Who the Agent of Service of Process Will Be

All California corporations are required to have an agent of service of process (also known as a registered agent) that is available from 9-5 daily at a CA physical address.

An individual (e.g., any officer, director or shareholder of the corporation) can serve as agent.

Failure to be present during regular business hours can result in a default judgement (which means the plaintiff automatically wins) in case of a lawsuit.

Alternatively, you can hire a company to serve as agent on your behalf.

Benefits of hiring a registered agent include privacy and freedom (not having to be available during business hours).

Make sure you are at the designated physical address, during regular business hours, if you designate yourself as registered agent when setting up your law corporation.

File Articles of Incorporation

The first step when creating a California Law Corporation is Filing Articles of Incorporation of a Professional Corporation with the California Secretary of State.

The Articles of Incorporation should include the name of the law corporation, the business address, the agent of service of process’ name and address, number of shares authorized and corporation purpose.

The Articles should also be customized to include indemnification provisions.

Prepare Organizational Corporate Minutes

The law corporation should prepare organizational corporate minutes which confirms the information in the Articles of Incorporation and which, among other things, appoints the corporation’s officers and directors.

Minutes are considered part of the corporate formalities of the law corporation are essential to have in case of lawsuit or audit.

Annual corporate minutes are also required by California law.

Prepare Bylaws

Bylaws set forth the law corporation’s operating procedures and rules.

Bylaws dictate the how the corporation is operated, where the corporation is located, time, place and manner of shareholder meetings, director powers, numbers, indemnification and elections, officer types, meetings and duties, stock issuance, record keeping and other general matters.

Bylaws are an important and official part of the records of the corporation and must be provided in case of a lawsuit or audit.

Lack of bylaws could be a factor toward piercing the corporate veil in case of a lawsuit.

Law corporations are also required to contain specific language mandated by the State Bar of California.

Lack of the specific language is among the most common reasons for returned applications when registering a law corporation with the State Bar of California.

The following language is required: (A) A shareholder of a law corporation must be licensed and entitled to practice law. (B) The shares of a law corporation must be owned only by that corporation or a shareholder. (C) The shares of a deceased shareholder must be sold or transferred to the law corporation or its shareholders within six months and one day following the date of death. (D) The share certificates of the law corporation must set forth the preceding restrictions of this rule regarding ownership, sale, or transfer of shares. These restrictions must also be set forth in the articles of incorporation or bylaws. (E) The shares of a shareholder who is ineligible to practice law or legally disqualified to render professional services to the law corporation must be sold or transferred to a qualified shareholder within ninety days after the date of ineligibility or disqualification. The terms of such a sale or transfer of shares must be set forth in the articles, the bylaws, or a written agreement. (F) The shares of a shareholder disqualified for any reason may be resold to that shareholder upon his or her becoming eligible to practice law.

California Law Corporation bylaws are often rejected by the California State Bar for having incorrect language. Via the CA State Bar website.

Issue Stock to the Shareholder(s)

Stock issuance is an often overlooked and important part of the corporation formation process.

Shareholders are the owners of the corporation and their ownership must be documented by shares of stock.

Stock certificates must include the corporation name, shareholder name, number of shares issued, number of shares authorized, issuance date and should be signed by the corporation’s president and secretary.

Additionally, California law corporations are required to have language setting forth the restrictions regarding ownership, sale, or transfer of shares.

Remember, stock of a California law corporation can only be held by a licensed California attorney.

Prepare a Stock Ledger

A stock ledger is a log documenting the shareholders, number of shares issued and date of issuance.

The stock ledger is also used to document stock issued in the future and stock transfers made in the future.

Obtain a Taxpayer Identification Number (TIN) for the Law Corporation

A TIN, which is also known as an Employer Identification Number (EIN) is an identifying number issued by the IRS for newly formed corporations. A TIN can be likened to a business Social Security Number.

You must use the EIN when opening the law corporation’s bank account and filing taxes.

The IRS form used to obtain the TIN/EIN is IRS Form SS-4.

The EIN can also be obtained online via the IRS website.

Frequently asked questions and answers can be found on the IRS Form SS-4 instructions.

File IRS Form 2553 (S Corporation Election)

If you would like the law corporation taxed as an S corporation, within 75 days of formation, IRS Form 2553 should be filed with the IRS.

Form 2553 must include the corporation name, formation date, address, EIN, representative and shareholders (and any spouses holding a community property interest).

Frequently asked questions and answers can be found on the IRS Form 2553 instructions.

File a Statement of Information

A Statement of Information must be filed with the California Sec. of State, within 90 days of incorporation. Failure to file will result in corporation suspension and assessment of a $250 penalty.

The Statement of Information must include the law corporation’s name, California Secretary of State entity number, business address, mailing address (if different), officers, directors, registered agent and type of business.

The filing fee is $25 and certified copies cost an additional $5.

A Statement of Information must also be filed annually along with the $25 payment.

File a Limited Offering Exemption Notice

A Limited Offering Exemption Notice should be filed with the CA Dept. of Financial Protection and Innovation within 15 days of share issuance, a If the value of shares stock is less than $25,000, the filing fee is $25.

Failure to file can result in a penalty being assessed.

The limited offering exemption notice basically let the government know that you are not selling stock to third parties and to exempt you from further securities filings.

Register the California Law Corporation With the State Bar of California

The law corporation must register with the State Bar of California, and obtain a Certificate of Registration, before can it engage in the practice of law.

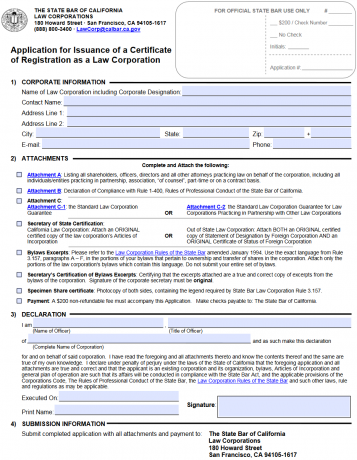

The Application for Issuance of a Certificate of Registration as a Law Corporation requires the corporation name, address, email and phone number.

The application also requires (a) a list of all shareholders, directors, officers and all other attorneys practicing law on behalf of the corporation; (b) a Declaration of Compliance with Rule 1-400 California Rules of Professional Conduct; (c) a law corporation guarantee; (d) a certified copy of the corporation’s Articles of Incorporation; (e) excerpts of the corporation’s bylaws including the language required by the State Bar; (f) photocopy of the corporation’s stock certificate which includes the legend required by the State Bar; and (g) a $200 application fee.

A Certificate of Registration renewal, should also be filed on an annual basis.

Law corporations must file an Application for Issuance of Certificate of Registration before engaging in the practice of law.

Open a Bank Account for the California Law Corporation

A bank account should be opened shortly after formation of the law corporation.

The account should solely be used for financial transactions associated with the law corporation.

Commingling of business and personal funds should be prevented at all costs since doing so could lead to invalidation of the corporation in case of a lawsuit.

The stock ledger should reflect the amount being deposited into the bank account in exchange for stock.

Obtain a Local Business License

Most cities require corporations operating within their boundaries to obtain a business license and pay local taxes.

The CAlGold website will help determine which licenses and permits are required for your new entity.

If your law corporation will be operating in the City of Los Angeles you can obtain a business license (also known as a Tax Registration Certificate) online.

Notify Third Parties

All parties with whom the law corporation will have a business relationship should be clearly informed that they are dealing with a corporation.

All contracts should be executed in the law corporation’s name.

Also be sure to notify insurance carriers about the new corporation.

Consult With an Accountant

Consult with an accountant immediately after the corporation is formed to discuss federal and state income, payroll and other taxes.

Remain in touch with your accountant to ensure you stay on top of all tax filing and payment deadlines since the government will not remind you about filing deadlines.

For example, law corporations are required to pay an $800 annual franchise tax starting the second calendar year of existence.

The California Franchise Tax Board (CA FTB) will not remind you about the $800 minimum tax payment.

Accordingly, it important to be working with a good accountant that can keep you on top of such requirements.

Stay on top of taxes and try to find an experienced business accountant since failure to file and pay taxes can lead to invalidation of the corporation.

Maintain Corporate Formalities

Being afforded the protection of the corporate structure requires that you comply with all formalities associated with being a corporation.

Be sure to prepare corporate minutes on an annual basis.

Also be sure to file the law corporation’s California Statement of Information on an annual basis.

Remain compliant and mark your calendar since failure to do so could result in penalties and invalidation of the corporation in case of a lawsuit.

Comply with the Corporate Transparency Act

A new federal law called the Corporate Transparency Act (CTA) is going into effect, in January of 2024, which requires that “beneficial ownership” be disclosed to the Dept. of Treasury Financial Crimes Enforcement Unit (FinCEN). This means that the federal government wants to know who actually owns a company and who may be controlling the company behind the scenes.

The purpose of the CTA is to clamp down on money laundering, tax evasion, cyber crime, terrorism and other bad acts facilitated by corporations and LLCs.

Willful violations of the Corporate Transparency Act can result in penalties of $500 a day (up to $10,000) and incarceration.

Make sure you are compliant once this historic law goes into effect.